名古屋市西区で中小企業の労務管理をサポートする女性社労士事務所

特定社会保険労務士・岩田労務管理事務所

Iwata Labor Management Office

日本で起業する中小企業の外国人経営者の方、外国人労働者の方 向けに、英語でのサービスも提供しています。

We are offering labor management services in English as well for entrepreneurs and employees of small and medium-sized enterprises. Please check the English page for details.

We are offering labor management services in English as well for entrepreneurs and employees of small and medium-sized enterprises. Please check the English page for details.

↓

Active Listening & Pursuit of Speedier

『寄り添いコンサルティング』と

『スピード手続対応』が持ち味の

特定社会保険労務士事務所です。

Open : 9:00~18:00

お気軽にお問合せください

052-551-4865

Have You Ever Had any Labor-Related Problems?:

If you have, you might have tackled with complicated and enormous amount of labor laws and regulations in Japan. Or the problems may have been rooted from other causes than legal issues as is often the case.

Legal issues are the requirements to be coped with in the first place, but there are other matters as well including emotinal entanglement often be left over and should be handled with care to avoid disputes.

Iwata Labor Management Office first separate the legal issues from other matters and give proper advice accordingly.

Our focus is to better serve our clients in an easy to understand and accessible manner and help solving probelms with the least burden for them.

Let an Experienced Sharoushi be Your Guide:

Everyday issues occuring in the workplace take on many different forms and can often bring your company to a standstill.

Having an experienced and knowledgeable sharoushi who can handle English in your corner will allow you to face these challenges with confidence as you seek these matters move forward.

Iwata Labor Management Office is ready to guide you through the process.

Services We Offer to Our Clients:

- Labor and Social Security Procedures in Establishing Small and Medium-sized Enterprises in Japan

- Legal Consultation on Personnel Management and Labor & Social Security Relations

- Drawing Up/Revision of Rules of Employment, Labor Contracts and Other Labor-Related Documents

- Payroll Calculation

- Processing of Labor and Social Insurance Procedures

- Subsidy Payment Application

- Witnessing of Labor and/or Social Insurance Investigations

About:

Special Sharoushi

Certified Career Consutant

Kyoko Iwata

Kyoko Iwata

Certifications; ・Labor and Social Security Attorney (Special Sharoushi) ・Certified Career Consultant ・2nd Grade Certified Skilled Professional of Career Consulting

Memberships; ・Aichi Labor and Social Security Attorney’s Association ・Career Consulting Conference ・Nagoya Chamber of Commerce & Industry

Involvement & Participation; ・Branch Chief of Nagoya West Branch of Aichi Labor and Social Security Attorney’s Association ・Consultant at Aichi Employment Consultation Center ・JETRO Expert Consulting for foreign companies starting business in Japan

Reach Out Today:

Reach Out Today:

We are happy to schedule in-person, video-based, or telephone appointments for your convenience.

If you have any questions, comments or concerns, please contact us.

Labor News:

Here are the latest English labor news and/or information in Japan.

2025.3.25 Workers' compensation for injuries sustained during Amazon delivery

On March 19th, lawyers representing a male freelance Amazon delivery driver revealed that the Miyazaki Labour Standards Office had granted him workers' compensation certification on 28th February for an injury he sustained in March 2012 while making deliveries. The man concluded an outsourcing contract with a shipping company that delivers packages for Amazon. Although he had not been literally "a worker" in the context of outsourcing contract, he was judged as a ‘worker’ and certified as having suffered a work-related injury. One of the reasons for this decision was that his delivery location and working hours were managed through Amazon's smartphone app. This is the second case of an Amazon delivery driver being certified as a "worker" in terms of worker's compensation insurance in the country.

2025.3.9 A manual was created common to all organizations for the prevention of customer harassment (Guide for the creation of industry manuals-Tokyo Metropolitan Government/TOKYO Hataraku Net)

The Tokyo Metropolitan Government/TOKYO Hataraku Net has announced that it has prepared and published a manual common to all organizations for the prevention of customer harassment (published 4th March 2025). This manual is intended to serve as a reference for industry associations when preparing manuals for their member companies that show the characteristics of customer harassment in their industry and recommended responses, etc. (Guide to the Preparation of Industry Manuals).The contents of the manual are useful not only for industry associations whose members are businesses operating in Tokyo, but also for other people. For more information, see.

<Manual common to all organizations for the prevention of customer harassment>https://www.hataraku.metro.tokyo.lg.jp/plan/kasuharamanual/index.html

Past labor news and information are here!

What Clients Have to Say About Us:

We are very fortunate to have formed excellent partnerships with our clients. Here’s what they’re saying about us.

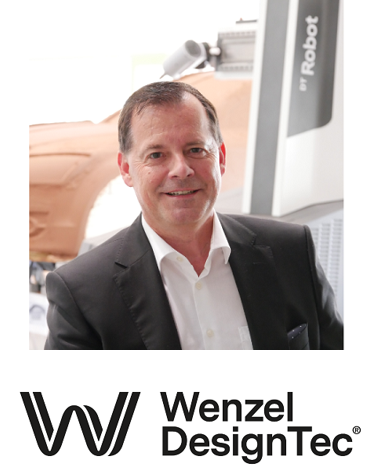

”As a foreigner, the journey to extend my business to Japan seemed an impossible task until I met Kyoko Iwata from Iwata Labor Management Office in April 2018 at JETRO Nagoya. Right from the beginning her knowledge about business related topics in Japan helped me to have confidence and clarity about the way forward. In the years since our founding, she has provided valuable consolations and helpful advice on every occasion that helped Wenzel Designtec to move faster, saving both time and money every step of the way. Looking back on the experience, I know that we selected the right business and employment partner in Japan and I recommend them 100%.”

Mr. Frank Wenzel, CEO of Wenzel DesignTec GmBH

"We are a staffing and training services provider of global human resources with our head office located in Nagoya. Both Japanese and English are spoken in the office as our CEO is originally from Canada and the number of foreign employees almost equals the number of Japanese employees.

With this international mix, there are various challenges in this global working environment. For example, Japanese-style office regulations are hard to understand for foreign employees, and explanations of social insurance and payroll deduction are required so that they can clearly understand the payslip breakdown. Also, the understanding of how overtime is calculated.

When concluding a labor-management agreement, background information needs to be explained bilingually, which is difficult to understand even for Japanese native speakers. Furthermore, foreign employees proactively express their opinions and requests, which is good for improving various challenges, but on the other hand, it is sometimes difficult to maintain consistency of company regulations.

Under such situations, Ms. Iwata supports our business and operation by listening to our different challenges and effectively provides a variety of proposals and possible solutions during her monthly visit. As a result, we are able to share information with all employees without any loss of time thanks to her swift action, making internal operations more efficient. In addition to this, she continually shares information that is difficult to obtain ourselves, such as subsidies and system introduction for job simplification.

She is the ideal business consultant who can provide necessary information and solutions for company executives working under limited time frames. We very much appreciate Ms. Iwata's support for the continued expansion and growth of our business."

Ms. Saeko Kitamura, COO of GDI Communications Inc.

Reach Out Today:

Reach Out Today:

We are happy to schedule in-person, video-based, or telephone appointments for your convenience.

If you have any questions, comments or concerns, please contact us.